Getty Photographs

Getty PhotographsUK college students can pay extra for college in England subsequent 12 months, as undergraduate tuition charges rise to £9,535 a 12 months.

It is a rise of £285 on the charges, which have been frozen at a most of £9,250 since 2017.

Training Secretary Bridget Phillipson instructed MPs in Parliament on Monday that upkeep loans would additionally go as much as assist college students handle the price of dwelling.

The Nationwide Union of College students known as the tutoring charges rise a “sticking plaster”, however mentioned larger upkeep loans “will make an actual distinction to the poorest college students”.

For universities, the upper charges are a money injection to help with their most fast monetary challenges.

Nonetheless, the announcement solely impacts charges and loans within the 2025/26 tutorial 12 months – and vice-chancellors will need to know what the federal government’s plans are past that.

Phillipson mentioned the federal government would announce additional “main reform” for long-term funding in universities within the coming months.

She mentioned the federal government was having to “take the robust selections wanted to place universities on a firmer monetary footing”.

However she instructed the BBC they’d even be “demanding extra of universities”, and taking a look at issues like how a lot prime bosses are paid, as a way to “drive higher worth for college kids and for the taxpayer”.

Prime Minister Keir Starmer had mentioned he needed to abolish tuition charges altogether when he ran for the management of the Labour Occasion in 2020.

However in 2023, he mentioned Labour was “more likely to transfer on” from the pledge. On this 12 months’s basic election marketing campaign, he confirmed he can be doing in order he needed to prioritise spending on the NHS.

Within the Commons on Monday, Conservative shadow schooling secretary Laura Trott known as the tutoring price rise “a hike within the efficient tax graduates should pay”.

Subsequent 12 months each tuition charges and upkeep loans shall be linked to a measure of inflation known as RPIX, which counts the price of every part besides mortgage curiosity prices.

It’s at present set at 3.1%.

That can enhance upkeep mortgage caps from £10,227 to £10,544 for college kids dwelling exterior of London, and from £13,348 to £13,762 in London.

Upkeep grants, which had been non-repayable, had been scrapped in 2016.

Of their evaluation of the adjustments, the Institute for Fiscal Research (IFS) mentioned the tutoring charges enhance would spare universities an extra real-terms reduce to their instructing assets.

However they urged the federal government to say whether or not charges would proceed to extend after subsequent 12 months, “to offer some certainty to universities and potential college students alike”.

In addition they mentioned that, beneath present compensation phrases, round 1 / 4 of the prolonged loans would finally be written off and paid by the taxpayer.

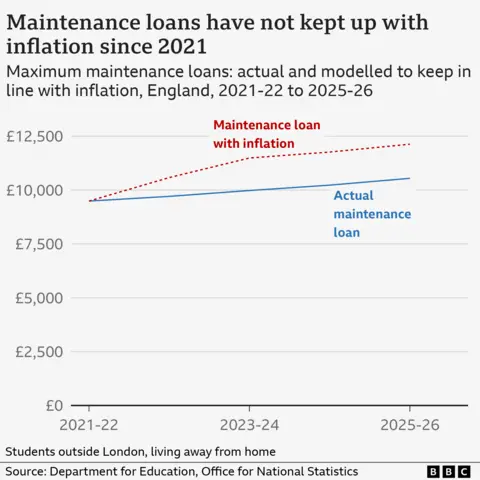

Though college students taking out the very best potential upkeep loans can be getting more cash subsequent 12 months, the IFS mentioned they’d nonetheless be borrowing 9% much less in actual phrases than they’d have completed in 2020/21.

The adjustments introduced on Monday will have an effect on college students beginning college subsequent 12 months, but in addition present college students – though universities can have contracts that shield their college students from price hikes part-way by way of a course.

College students Shay and Zay, each of their first 12 months finding out product design at Manchester Metropolitan College, mentioned larger charges may delay potential college students.

Branwen Jeffreys / BBC

Branwen Jeffreys / BBCZay mentioned tuition charges had been “already fairly a giant issue enjoying on lots of people’s minds” when deciding whether or not to go to school.

Shay mentioned college was “already costly as it’s”, however added that he was extra apprehensive about his upkeep cash having the ability to cowl the price of dwelling.

Private finance knowledgeable Martin Lewis has mentioned the tutoring price adjustments are “more likely to be trivial”, particularly in contrast with college students who began college in 2023.

Final 12 months, mortgage phrases had been elevated from 30 to 40 years and compensation threshold salaries had been dropped from £27,295 to £25,000, that means extra graduates can be repaying their loans for longer.

Tom Allingham, from the Save the Scholar cash recommendation web site, mentioned that regardless of their “dismay” on the enhance in charges, it might make “little distinction to general ranges of pupil debt, and may have no impression by any means on the quantity a graduate repays every month”.

That sentiment was mirrored by sixth formers in Oldham contemplating their college decisions for subsequent 12 months.

Niamh, who needs to check English literature, mentioned tuition charges weren’t rising by a “big quantity”, however that upkeep mortgage will increase had been “positively wanted” to assist college students.

She mentioned prices for college college students had been “ridiculous”, so “even somewhat bit of additional assist is welcome”.

James, who needs to check engineering, mentioned he thought it was “unfair” that he was going to should work to assist fund his dwelling prices at college, even with the elevated upkeep loans.

Hope Rhodes / BBC

Hope Rhodes / BBCSarah Coles, head of private finance at Hargreaves Lansdown, a monetary companies agency, mentioned mother and father of younger kids ought to begin saving now for his or her college years.

She suggested mother and father of older kids to “be clear about what stage of economic assist they’ll anticipate from you”.

Vivienne Stern, chief government of Universities UK, which represents 141 universities, mentioned the federal government’s determination to vary tuition charges was “the proper factor to do”.

She mentioned the freeze had been “utterly unsustainable for each college students and universities”.

However Jo Grady, basic secretary of the College and Faculty Union, mentioned elevating tuition charges was “economically and morally incorrect” and that the federal government was “taking more cash from debt-ridden college students” to assist universities.

The adjustments come after rising issues concerning the state of college funds within the UK.

The Workplace for College students, the upper schooling regulator in England, warned that 40% of universities have predicted a deficit on this tutorial 12 months.

In July, Phillipson mentioned universities ought to “handle their budgets” amid requires the federal government to bail out struggling establishments.

Universities UK has beforehand steered tuition charges would wish to rise to £12,500 a 12 months to adequately meet instructing prices.

However in addition they acknowledged that asking for that quantity would appear “clueless” and “out of contact”.

The federal government hopes that growing upkeep assist will assist college students with day-to-day dwelling prices like meals and lodging.

However larger tuition charges and elevated upkeep loans will imply college students must borrow extra to go to school, and can go away with extra debt.

The Division for Training will publish an impression evaluation quickly, alongside laws setting out the adjustments. It’ll have a look at the impression of the adjustments on college students’ debt at commencement, and their repayments over time.

The tripling of charges in England in 2012 prompted widespread protests.

Since then, they’ve solely elevated as soon as, in October 2017, when then-prime minister Theresa Could introduced a £250 rise.