Price of dwelling correspondent

Getty Pictures

Getty PicturesTwo main lenders launched mortgage offers on Thursday with rates of interest of lower than 4%, as competitors picks up within the sector.

The prospect of additional cuts within the base charge by the Financial institution of England has given mortgage suppliers confidence to cut back their very own charges.

However the attention-grabbing sub-4% offers by Santander and Barclays won’t be out there to all debtors, and will include a hefty charge.

The return of such offers may immediate different lenders to observe swimsuit after a interval of tepid competitors.

Mortgage offers with rates of interest beneath 4% haven’t been seen since November.

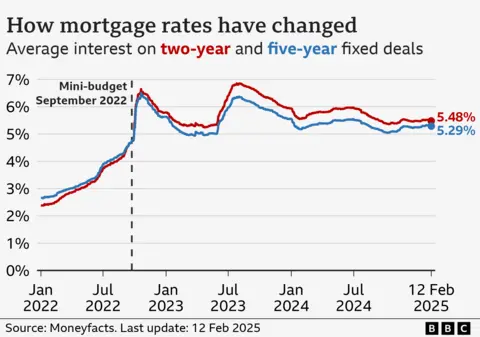

Throughout the entire market the typical charge on a two-year mounted deal is 5.48%. The everyday charge on five-year offers is 5.29%, in accordance with newest figures from Moneyfacts.

“Debtors have been crying out for higher mortgage charges and we’re beginning to see them,” stated Aaron Strutt, of dealer Trinity Monetary.

“In case your mortgage is developing for renewal quickly and you’ve got already chosen a brand new deal, it’s a good time to overview it and probably swap to a greater charge.”

Time to determine

Some tracker and variable charge mortgages transfer pretty intently according to the Financial institution’s base charge, which was lower to 4.5% per week in the past. Nonetheless, greater than eight in 10 mortgage clients have fixed-rate offers.

The rate of interest on this sort of mortgage doesn’t change till the deal expires, normally after two or 5 years, and a brand new one is chosen to exchange it.

About 800,000 fixed-rate mortgages, at the moment with an rate of interest of three% or beneath, are anticipated to run out yearly, on common, till the tip of 2027.

Meaning the next month-to-month invoice for a lot of owners on their subsequent renewal, however there are indicators that the speed they might pay is on its approach down.

Financial institution of England governor Andrew Bailey stated the interest-rate setting committee anticipated to have the ability to lower charges additional “however we should decide assembly by assembly, how far and how briskly”.

This can have an effect on savers who’re seeing decrease returns, however may carry higher information for debtors. The Financial institution’s subsequent charges determination is on 20 March.

The markets and lenders predict extra base charge cuts this 12 months, seen by way of so-called swap charges. So, charges for brand new mounted mortgage offers are predicted to fall – particularly as mortgage suppliers have a tendency to maneuver as a pack.

“It was solely a matter of time for lenders to carry again sub-4% mortgages,” stated Rachel Springall, from monetary data service Moneyfacts.

“It is a constructive injection to the mortgage market and when a giant lender makes such a transfer, it will possibly immediate its friends to observe swimsuit with cuts of their very own.

“The hundreds of thousands of mortgage debtors trying to refinance this 12 months want some excellent news.”

Learn the small print

Eligible debtors for the sub-4% charges will want a 40% deposit, which is able to shut off these offers to many debtors, particularly some first-time consumers.

They could even have a comparatively massive charge, so debtors might want to verify whether or not the general worth works for them.

Extra demand for properties from consumers may very well be generated if mortgage charges fall for a protracted interval.

In its newest survey, the Royal Establishment of Chartered Surveyors (RICS) stated that housing market exercise was anticipated to select up over the approaching months following a flat begin to the 12 months.

Methods to make your mortgage extra inexpensive

Learn extra right here