Know-how reporter

Getty Pictures

Getty PicturesBarclays clients are experiencing intermittent errors with funds and transfers for a second day after severe IT issues that additionally affected the financial institution’s app and on-line banking.

Clients have instructed the BBC they’re unable to make important transactions, starting from shopping for child milk to finishing a home transfer.

Barclays mentioned on Saturday that playing cards and money machines could possibly be used as regular – though some clients have mentioned this isn’t the case.

A Barclays spokesperson mentioned the financial institution is “working laborious to repair the difficulty” and that it’s going to “make sure that no impacted buyer is ignored of pocket”.

The outage started on Friday, which was pay day for many individuals within the UK, and the deadline for self-assessment tax returns.

Barclays has not defined the reason for the IT issues or how many individuals are affected.

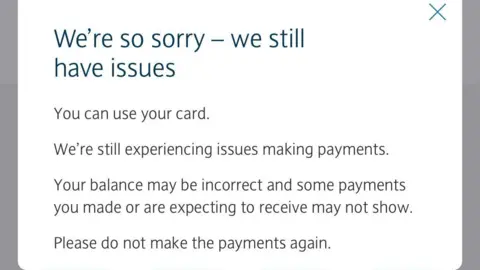

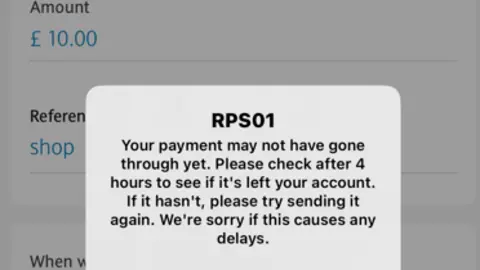

On Saturday afternoon, Barclays’ web site indicated that issues endured with its app, and warned that clients might face points making and receiving funds.

The web site additionally instructed clients that the financial institution might not have the ability to help with all queries in branches “on account of points we’re dealing with”.

It warned clients on its web site to “be vigilant” in the course of the outage as a result of “fraudsters typically use instances like this to ship messages pretending to be Barclays”.

Barclays buyer Diane Forrest in Teddington, London, mentioned she was supposed to finish the sale on a home on Friday.

“I sat exterior the brand new home with all belongings in a elimination truck for over 4 hours however no different answer could possibly be discovered,” she instructed the BBC.

The 61-year-old mentioned she was in a lodge for the weekend and has “a number of thousand kilos extra prices to incur” and “no pals free to assist with the [house] removals in the event that they go forward on Monday”.

Businessman Tim Horner from Petworth, West Sussex, mentioned on Saturday he has been unable to pay his workers or HMRC.

He instructed the BBC that he has had “a number of calls” from folks making an attempt to make funds to his ecommerce platform, saying that their funds are “being refused”.

“I’ve misplaced hundreds of kilos on account of my on-line retailer being unable to obtain funds as we have now a Barclays account,” Mr Horner mentioned.

Ruth, 39, a self-employed cleaner, instructed BBC Information she had been making an attempt to entry cash along with her accomplice from their financial savings account for a number of hours so she may purchase milk for a child and meals for 5 different kids she is taking care of at house.

“We’d like the cash to do procuring, our cash is all in financial savings,” she defined.

“I’ve bought my granddaughter right here who’s 11 months previous, additionally a one-year-old, two-year-old, 12-year-old, 13-year-old, 15-year-old all at house.”

She mentioned she had been capable of get some assist from her teenage daughter, however mentioned there could possibly be “many single mums in the identical state of affairs with no entry to cash”.

BBC viewer Ruth

BBC viewer RuthEmily from Exeter instructed the BBC that she is spending the weekend on a buddy’s couch after being unable to maneuver into her new home on Friday.

“I am successfully homeless with my two kids and two cats,” she mentioned, including that her kids had been staying with household.

“My elimination van is deserted with every part I’ve in it,” the 44-year-old mentioned. “My cash is who is aware of the place. My cats [were] coated in excrement from being in carriers for hours.”

“I am a single mom who has labored extremely laborious for this and to be left homeless is indescribable.”

Barclays is without doubt one of the UK’s largest banks, with over 20 million UK retail clients. It says it processes over 40% of the UK’s credit score and debit card transactions.

Web site downdetector, which displays outages, says hundreds of individuals have flagged issues on the financial institution. On Saturday morning, it confirmed greater than 4,000 points had been reported with Barclays, greater than double the quantity reported on Friday.

Tax return anxiousness

Friday was the deadline for self-assessment tax returns, and a few clients have mentioned the outage has left them unable to make funds to HMRC.

Earlier on Friday, HMRC warned that hundreds of thousands of individuals have nonetheless not filed their self-assessment tax returns, and warned of £100 fines for individuals who didn’t meet the deadline.

Nonetheless, in a press release to the BBC, HMRC mentioned it was “working carefully” with Barclays to minimise any impression on clients submitting their self-assessments.

A spokesperson added: “Our providers are working as regular, so clients will have the ability to file their returns on time.

HMRC added that Barclays points “won’t end in late cost penalties as they do not apply till 1st March”.

In a press release, Barclays mentioned: “We’re in direct contact with HMRC and they’re conscious of the technical points with our system.”

It added: “We are going to make sure that no buyer is ignored of pocket due to delayed funds attributable to this incident.”

Outage after outage

A Barclays spokesperson mentioned the financial institution was “extremely sorry for the continued technical points” affecting clients’ accounts.

“Some may even see an outdated steadiness, and funds made or acquired might not present,” they mentioned.

“We’re working laborious to repair this challenge, and clients mustn’t attempt to make the cost once more.”

“Clients can use their playing cards and withdraw money, and as quickly as these remaining points are resolved, we’ll let our clients know,” the spokesperson added.

They mentioned Barclays was conserving its name centres open for longer on Saturday and Sunday and that it could be “proactively contacting clients who could also be weak”.

Further reporting by Liv McMahon and Kris Bramwell