China not too long ago banned the export of the minerals gallium and germanium to the US amid rising tensions between the 2 nations on commerce.

The minerals are of important financial worth as a result of they’re utilized in pc chips, in army expertise akin to evening imaginative and prescient goggles, and within the renewable vitality business, the place they’re necessary for manufacturing electrical automobiles and photo voltaic cells. All of those areas are very delicate sectors for the US and EU.

China has overwhelming market energy over provide, as a result of it’s the supply of 98% of major gallium and 91% of major germanium. Main refers to “uncooked” sources akin to mineral ore. In a number of sectors the place the minerals are used, there aren’t any substitutes for them.

Gallium and germanium are current in very low focus as byproducts of main minerals – they’re generally known as hint minerals. Germanium’s major supply is the residue from zinc refineries and coal fly ash (a powdered residue produced when coal is burnt in energy crops).

Gallium is principally produced as a byproduct of bauxite ore (which is the primary supply for aluminium) in addition to the processing stage to extract aluminium from bauxite.

The Chinese language ban on exports of those minerals to the US intently adopted Washington’s third crackdown in three years on China’s semiconductor (pc chip) business. The US desires to curb exports of superior chips to China that may very well be utilized in functions that threaten America’s safety.

E-Rik / Shutterstock

For instance, superior chips may very well be utilized in digital warfare functions that make use of synthetic intelligence (AI), or in superior weapons programs akin to hypersonic missiles. China stated its ban on gallium and germanium was due to the minerals’ “twin army and civilian makes use of”.

In keeping with a report in Reuters in 2023, the US Division of Protection holds a strategic stockpile of germanium, however no reserves of gallium. In October 2024, the US Geological Survey (USGS) estimated {that a} complete ban on the export of gallium and germanium might lead to a US$3.4 billion loss to US GDP.

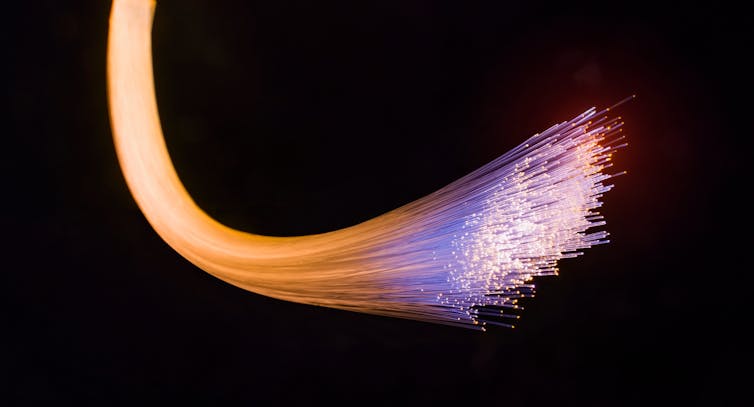

The minerals’ makes use of prolong far past nationwide safety functions. Gallium is utilized in solid-state lighting units, together with light-emitting diodes (LEDs). Germanium is utilized in optical fibres and as a catalyst to hurry up the reactions utilized in manufacturing polyster and PLA (a bioplastic). The minerals are very important for making the digital units we rely on each day, akin to smartphones, shows and laptops.

Asharkyu / Shutterstock

So what can the US do to bypass the consequences of the ban, given China’s close to monopoly on the first manufacturing of those important minerals?

One route is for the US to re-start and broaden home mining of those minerals. Certainly, the Pentagon has already indicated that that is being explored.

As beforehand talked about, gallium is principally recovered as a byproduct of processing aluminium or zinc ores. The USGS says that some US zinc deposits include as much as 50 components per million of gallium, however the mineral just isn’t at the moment recovered from these deposits.

US Military

Traditionally, reported manufacturing of germanium within the US has been restricted to at least one website, the Apex mine in Washington County, Utah. The Apex mine produced each gallium and germanium as major merchandise in the course of the mid-Eighties, but it surely has since closed.

An alternative choice for the US is to diversify the first manufacturing of those minerals by investing in zinc, coal, and bauxite refineries in different, pleasant nations since, as an example, solely 3-5% of germanium is recovered from the refining technique of zinc and coal. Canada’s Teck Assets is the most important provider of germanium in North America, extracting the mineral from its Path smelter in British Columbia.

An alternate can be to step up extraction from so-called secondary sources, which primarily means recycling outdated digital units and different {hardware} that has reached the top of its helpful life. There aren’t any official statistics on secondary provide, however some studies estimate that not more than 10% of the full gallium provide comes from secondary sources. This share reaches 30% within the case of germanium.

Nevertheless, there are necessary obstacles to rising the secondary manufacturing of those minerals. The method for restoration by way of recycling may be very complicated since, in {hardware} akin to pc chips, the minerals are often mixed with different supplies. This makes isolating the minerals troublesome.

Consequently, the Chinese language ban represents a significant provide chain disruption for these minerals. The decrease major provide can’t be offset by secondary provide (recycling) within the brief time period, because the restoration yield remains to be low and its price just isn’t aggressive.

In the long run, technological advances on this restoration course of for each minerals might scale back its price and improve the provision, thus lowering the dependence on Chinese language mineral ores.