Getty Photographs

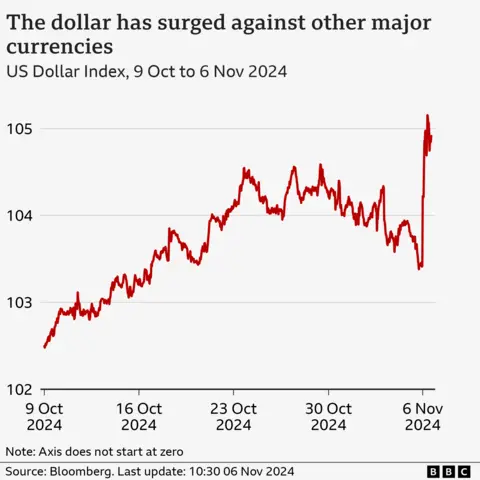

Getty PhotographsThe US greenback has surged as Donald Trump is now projected to have gained the presidency and can re-enter the White Home.

Bitcoin has additionally hit a file excessive whereas merchants guess on potential tax cuts, elevated tariffs, and rising inflation below Trump’s second time period.

This election end result may have a significant affect on the worldwide economic system.

The Republican Social gathering can also be set to take management of the Senate, though there are nonetheless votes left to rely.

The greenback has soared by about 1.4% in opposition to a bunch of various currencies, together with the pound, euro and the Japanese yen.

In Japan, the benchmark Nikkei 225 inventory index ended the session up by 2.6%, whereas Australia’s ASX 200 closed 0.8% increased.

The key US inventory indexes additionally look more likely to open sharply increased. That got here after the Dow Jones Industrial Common, S&P 500 and Nasdaq all closed greater than 1% increased on Tuesday.

Why is Bitcoin going up?

The worth of Bitcoin has additionally jumped by $6,000 (£4,645) to a file excessive of $75,371.69, surpassing the earlier excessive of $73,797.98 seen in March this yr.

Trump has beforehand pledged to make the US the “bitcoin and cryptocurrency capital of the world”.

His strategy stands in stark distinction with that of the Biden administration, which led a sweeping crackdown on crypto companies in recent times.

Trump had steered that he would fireplace Gary Gensler, the chair of the Securities and Alternate Fee who has acquired a backlash on-line from advocates of the digital forex.

This is because of Mr Gensler’s company introducing new guidelines round environmental disclosures, which have been paused, in addition to authorized motion in opposition to crypto firms.

Trump has additionally mentioned he plans to place billionaire Elon Musk answerable for an audit of governmental waste.

Mr Musk has lengthy been a proponent of cryptocurrencies and his firm Tesla famously invested $1.5bn in Bitcoin in 2021, though the worth of the digital forex could be very unstable.

Tesla’s Frankfurt-listed shares rallied over 14% on the open on Wednesday. Mr Musk, Tesla’s prime shareholder, has supported Trump all through his electoral marketing campaign.

Specialists predicted a turbulent day elsewhere on monetary markets, nevertheless, as a response to world uncertainty and Trump’s potential plans for the economic system.

US bond yields, the return a authorities guarantees to pay patrons of its money owed, additionally soared on Wednesday.

A bond is actually an IOU that may be traded within the monetary markets and governments usually promote bonds to traders once they wish to borrow cash.

Analysts have steered this could possibly be all the way down to merchants anticipating that a few of Trump’s financial measures might result in increased costs.

Donald Trump has mentioned, for instance, he would dramatically enhance commerce tariffs, particularly on China, if he grew to become the subsequent US president.

Tariff affect

Some economists have warned that Trump’s proposals round commerce would come as a “shock” to the UK economic system.

Ahmet Kaya, principal economist for the Nationwide Institute of Financial and Social Analysis (Niesr), mentioned it could possibly be “one of many nations most affected” below such plans.

It estimates that financial progress within the UK would sluggish to 0.4% in 2025, down from a forecast of 1.2%.

Katrina Ell, director of financial analysis at Moody’s Analytics mentioned: “Trump’s world commerce insurance policies are inflicting explicit angst in Asia, given the robust protectionist platform on which extra aggressive tariffs on imports into the US have been pledged.”

Trump’s extra isolationist stance on international coverage has additionally raised questions on his willingness to defend Taiwan in opposition to potential aggression from China.

The self-ruling island is a significant producer of pc chips, that are essential to the know-how that drives the worldwide economic system.

In mainland China, the Shanghai Composite Index ended the day down 0.1%, whereas Hong Kong’s Hold Seng was down by round 2.23%.

Trump’s tax-cutting agenda has been broadly welcomed by massive corporates within the US.

“We must always see pro-business insurance policies and tax cuts, in flip probably driving up inflation and fewer price cuts,” mentioned Jun Bei Liu, portfolio supervisor at Tribeca Funding Companions.

Traders additionally produce other key points to concentrate on this week.

On Thursday, the US Federal Reserve is because of announce its newest choice on rates of interest.

Feedback from the top of the central financial institution, Jerome Powell, shall be watched carefully all over the world.

On Friday, prime Chinese language officers are anticipated to unveil extra particulars about Beijing’s plans to sort out the slowdown of the world’s second largest economic system.