Help trulyindependent journalism

Discover out extraShut

Our mission is to ship unbiased, fact-based reporting that holds energy to account and exposes the reality.

Whether or not $5 or $50, each contribution counts.

Help us to ship journalism with out an agenda.

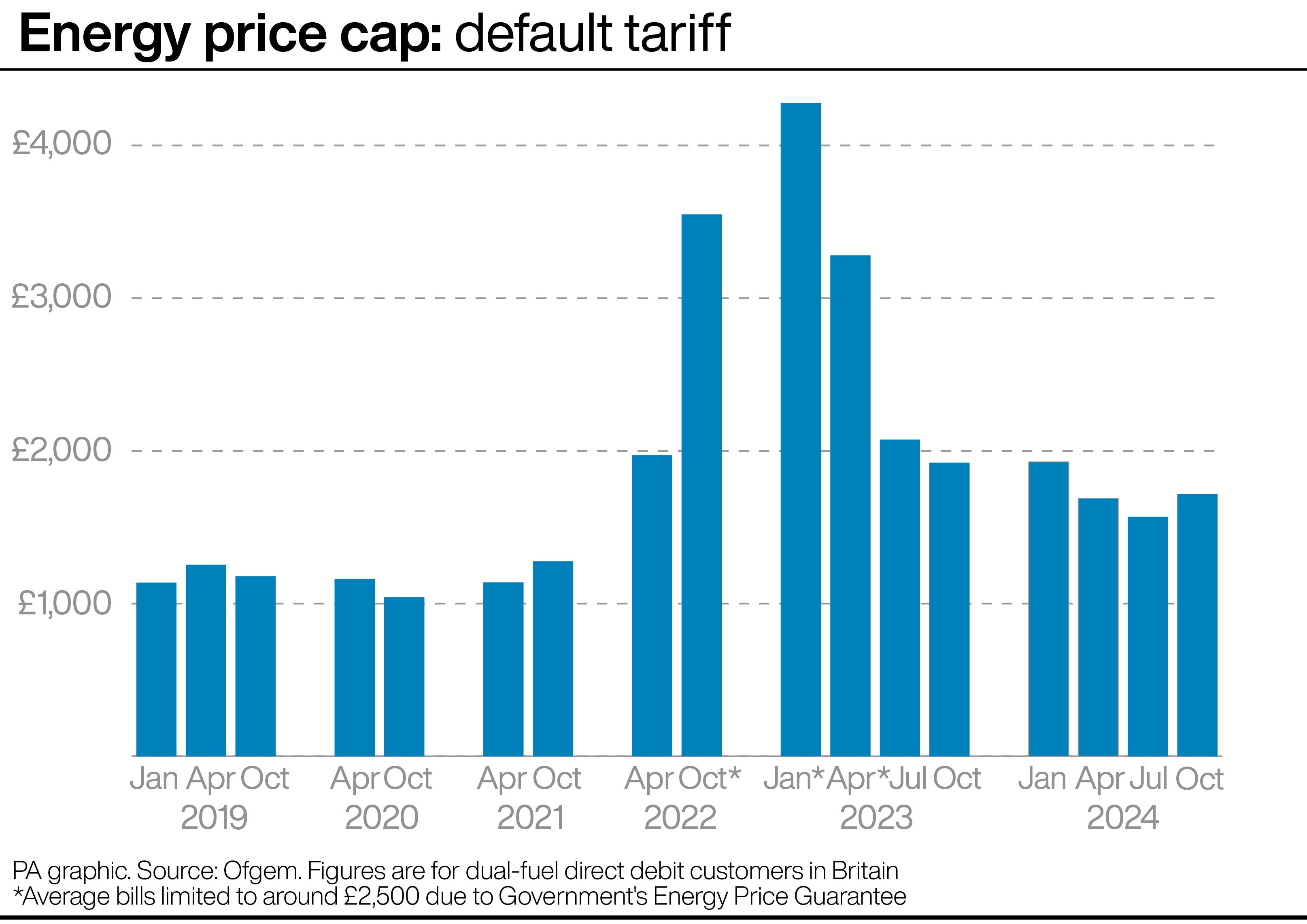

The vitality regulator has confirmed the typical family vitality invoice will rise from October this yr, which might imply properties throughout Britain are going through increased payments this winter.

Ofgem’s value cap will rise by £149 from the present £1,568 a yr for a typical family in England, Scotland and Wales to £1,717.

Right here‘s a take a look at why the value cap goes up and what individuals can do to mitigate the price of their vitality payments.

What’s Ofgem’s value cap?

The vitality value cap units a most value that vitality suppliers can cost shoppers in England, Scotland and Wales for every kilowatt hour (kWh) of vitality they use.

The figures supplied by Ofgem point out what a family utilizing fuel and electrical energy, and paying by direct debit, can anticipate to pay if their vitality consumption is typical.

You will need to word that it doesn’t restrict a house’s complete payments as a result of individuals nonetheless pay for the quantity of vitality they use – so whether it is above the typical they may extra, and if it under they may pay much less.

Vitality is regulated individually in Northern Eire.

I’d encourage individuals to buy round and think about fixing if there’s a tariff that’s best for you

Jonathan Brearley, Ofgem’s chief govt

Why is the value cap rising?

Ofgem mentioned the primary purpose why it has determined to extend the cap is due to rising wholesale costs within the worldwide vitality market, which has been attributable to heightened geopolitical tensions and excessive climate occasions.

Jonathan Brearley, Ofgem’s chief govt, mentioned “worldwide fuel costs – the fuel that we purchase to warmth our properties and to verify now we have the electrical energy we want – has gone up, and that’s feeding by to our payments”.

“In the end, whereas we’re depending on fuel, we might be on this scenario the place costs go up and down,” he advised Sky Information.

What can I do to decrease my payments?

Mr Brearley mentioned he was encouraging individuals to “store round” to see if they’ll get a greater deal on their vitality tariff.

“For the primary time in a very long time, we’re seeing some good worth offers emerge,” he mentioned.

“I’d encourage individuals to buy round and think about fixing if there’s a tariff that’s best for you – there are alternatives accessible that would prevent cash, whereas additionally providing the safety of a charge that received’t change for a set interval.”

As a rule of thumb, we would advocate in search of offers across the value of the present value cap, not longer than 12 months and with out vital exit charges

Emily Seymour, Which? vitality editor

Martin Lewis, the founding father of MoneySavingExpert.com, mentioned individuals “can and will save by switching” their vitality provider, and think about a fixed-price vitality tariff.

“The most affordable year-long fixes available on the market proper now are about 7% lower than the brand new October value cap, however they won’t be round lengthy,” he cautioned.

Mr Lewis advised that folks search for the most cost effective choice for his or her use and site, and might use comparability websites to search out and examine offers.

Emily Seymour, the vitality editor or Which?, mentioned: “Sadly, there’s no ‘one measurement matches all’ method in terms of fixing an vitality deal as it can all rely in your particular person circumstances.

“It’s best to examine what your month-to-month funds could be on a set cope with what you’d anticipate them to be should you stay with the price-capped variable tariff to see what the most suitable choice is for you.

“As a rule of thumb, we’d advocate in search of offers across the value of the present value cap, not longer than 12 months and with out vital exit charges.”

What assist is out there for me?

Ofgem urged individuals to benefit from any state advantages they’re entitled to, which might assist with paying vitality payments in addition to the broader value of dwelling.

Round 1.4 million pensioners are already receiving pension credit score, however the Authorities estimates as much as 880,000 additional households are eligible for the assist for these with a low earnings.

Folks receiving pension credit score qualifies them for the winter gas cost value as much as £300, to assist with payments.

Beforehand, anybody over state pension age might obtain the cost, however this was modified by the brand new Authorities, which means about 10 million pensioners will miss out this yr.

I believe I’m going to battle to pay my payments, what can I do?

Individuals are inspired to contact their vitality provider if they’re apprehensive about paying their payments.

Vitality firms are required to work with clients to agree on a cost plan they’ll afford, which might imply extra flexibility over how and at what time individuals pay.

They need to take into consideration individuals’s earnings and outgoings, money owed and private circumstances, and an estimate of how a lot vitality might be utilized in future, for which common meter readings will help construct a extra correct image.

Richard Lane, of debt charity StepChange, mentioned it was a “fear {that a} rise within the value cap could tip struggling households into deeper debt.”

He urged the Authorities to introduce focused assist for individuals who are struggling probably the most.