Sergio Ermotti, CEO of Swiss banking big UBS, through the group’s annual shareholders assembly in Zurich on Could 2, 2013.

Fabrice Coffrini | Afp | Getty Photographs

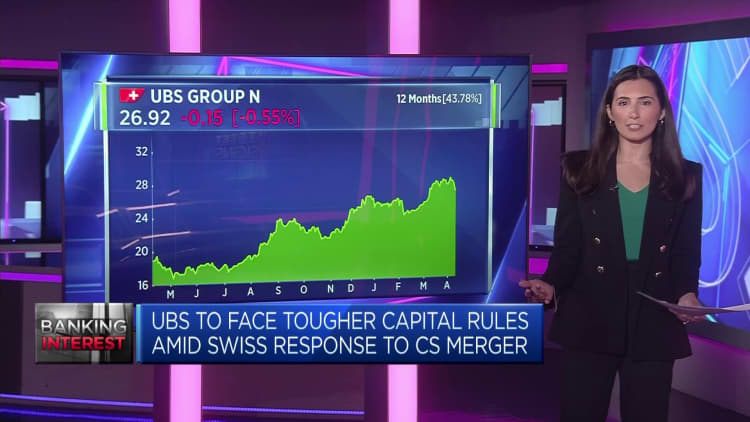

Switzerland’s robust new banking rules create a “lose-lose scenario” for UBS and will restrict its potential to problem Wall Avenue giants, in accordance with Beat Wittmann, companion at Zurich-based Porta Advisors.

In a 209-page plan revealed Wednesday, the Swiss authorities proposed 22 measures aimed toward tightening its policing of banks deemed “too large to fail,” a yr after authorities had been compelled to dealer the emergency rescue of Credit score Suisse by UBS.

The federal government-backed takeover was the largest merger of two systemically vital banks for the reason that World Monetary Disaster.

At $1.7 trillion, the UBS steadiness sheet is now double the nation’s annual GDP, prompting enhanced scrutiny of the protections surrounding the Swiss banking sector and the broader economic system within the wake of the Credit score Suisse collapse.

Chatting with CNBC’s “Squawk Field Europe” on Thursday, Wittmann mentioned that the autumn of Credit score Suisse was “a completely self-inflicted and predictable failure of presidency coverage, central financial institution, regulator, and above all [of the] finance minister.”

“Then after all Credit score Suisse had a failed, unsustainable enterprise mannequin and an incompetent management, and it was all indicated by an ever-falling share worth and by the credit score spreads all through [20]22, [which was] fully ignored as a result of there isn’t any institutionalized know-how on the policymaker ranges, actually, to observe capital markets, which is crucial within the case of the banking sector,” he added.

The Wednesday report floated giving further powers to the Swiss Monetary Market Supervisory Authority, making use of capital surcharges and fortifying the monetary place of subsidiaries — however stopped wanting recommending a “blanket improve” in capital necessities.

Wittman steered the report does nothing to assuage considerations in regards to the skill of politicians and regulators to supervise banks whereas guaranteeing their world competitiveness, saying it “creates a lose-lose scenario for Switzerland as a monetary middle and for UBS not to have the ability to develop its potential.”

He argued that regulatory reform must be prioritized over tightening the screws on the nation’s largest banks, if UBS is to capitalize on its newfound scale and eventually problem the likes of Goldman Sachs, JPMorgan, Citigroup and Morgan Stanley — which have equally sized steadiness sheets, however commerce at s a lot greater valuation.

“It comes all the way down to the regulatory degree enjoying discipline. It is about competences after all after which in regards to the incentives and the regulatory framework, and the regulatory framework like capital necessities is a world degree train,” Wittmann mentioned.

“It can’t be that Switzerland or every other jurisdiction is imposing very, very totally different guidelines and ranges there — that does not make any sense, you then can not actually compete.”

To ensure that UBS to optimize its potential, Wittmann argued that the Swiss regulatory regime ought to come into line with that in Frankfurt, London and New York, however mentioned that the Wednesday report confirmed “no will to interact in any related reforms” that will defend the Swiss economic system and taxpayers, however allow UBS to “catch as much as world gamers and U.S. valuations.”

“The monitor file of the policymakers in Switzerland is that we had three world systemically related banks, and we’ve got now one left, and these instances had been the direct results of inadequate regulation and the enforcement of the regulation,” he mentioned.

“FINMA had all of the authorized backdrop, the devices in place to deal with the scenario however they did not apply it — that is the purpose — and now we speak about fines, and that appears like pennywise and pound silly to me.”