Getty Pictures

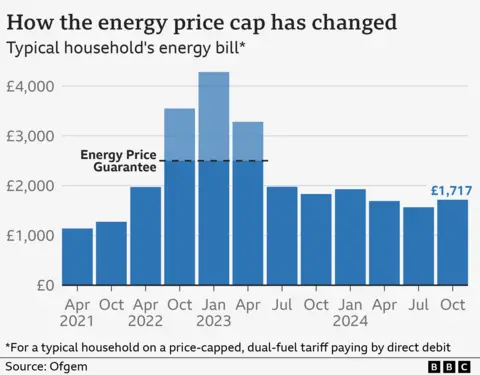

Getty PicturesA typical family’s annual power invoice will rise by £149 in October beneath the brand new worth cap.

Individuals utilizing a mean quantity of gasoline and electrical energy pays £1,717 a 12 months, a ten% rise in contrast with now.

The cap, set by the power regulator Ofgem, impacts the value paid for every unit of gasoline and electrical energy utilized in 27 million properties in England, Wales and Scotland.

Though costs are nonetheless decrease than final winter, the rise in payments comes as some help for payments has been withdrawn, and the brand new authorities has introduced it can halt winter gasoline funds for 10 million pensioners in England and Wales.

Vitality costs have fallen twice this 12 months – in April and July – however will head again up within the run-up to winter, by about £12 a month for a typical consumer.

To calculate the impact on what households pays this autumn, billpayers can add 10% to their present annual invoice.

The rise within the worth cap is the results of greater costs on the worldwide power market, Ofgem stated, owing to growing geopolitical tensions and excessive climate driving competitors and demand for gasoline, which determines the value of wholesale electrical energy.

Payments will stay about £117 a 12 months cheaper for a typical family than in October final 12 months, however analysts say one other rise in costs is probably going in January.

Standing fees are rising by one penny a day for gasoline and in addition for electrical energy, however the regulator is contemplating reforming the system.

How your invoice will change in October

In particular phrases:

Fuel costs can be capped at 6.24p per kilowatt hour (kWh), and electrical energy at 24.5p per kWh – up from 5.48p and 22.36p respectively now. A typical family makes use of 2,700 kWh of electrical energy a 12 months, and 11,500 kWh of gasHouseholds on prepayment meters pays barely lower than these on direct debit, with a typical invoice of £1,669Those who pay their payments each three months by money or cheque pays extra, with a typical invoice of £1,829Standing fees – a set every day cost protecting the prices of connecting to a provide – will go as much as 61p a day for electrical energy and 32p a day for gasoline, in contrast with 60p and 31p respectively now, though they differ by area

Costs are a lot decrease than their peak, however they continue to be effectively above pre-Covid pandemic ranges, and monetary help from the federal government has both been wound down or is being reduce.

The ultimate cost-of-living fee was made to eight million folks on means-tested advantages in February, and the brand new authorities has introduced it can cease winter gasoline funds for 10 million pensioners in England and Wales. The fee is a devolved matter in Scotland and Northern Eire.

That can hit Billy and Sylvia Cunningham, a pair aged of their 70s from Warrington.

“We did get the assistance final 12 months, however we nonetheless felt the chilly, we nonetheless needed to wrap in blankets and watch the sensible meter capturing up,” stated Mrs Cunningham.

Her husband has Parkinson’s and struggles when he will get chilly. “It’s onerous work generally,” he stated. “In case your fingers are freezing, you’ll be able to’t do nothing.”

The couple are simply £100 above the brink to qualify for pension credit score, a state pension top-up, and so may even miss out on the winter gasoline fee price one other £200. One sudden invoice, they stated, might push them into an overdraft as greater costs had already eroded their financial savings buffer.

Some households are already in debt to their provider and now face elevated costs within the run as much as winter.

Ofgem chief government Jonathan Brearley stated costs could be “unstable” within the long-term and so constructing a low-carbon, homegrown power system was a smart coverage.

Vitality Secretary Ed Miliband stated the rise in costs could be “deeply worrying” for households.

“We may even do the whole lot in our energy to guard billpayers, together with by reforming the regulator to make it a robust client champion, working to make standing fees fairer, and a correct heat properties plan to avoid wasting households cash,” he stated.

Standing fees overhaul

Though the value cap is modified each three months, it’s illustrated by Ofgem by way of an annual invoice for a family utilizing a typical quantity of gasoline and electrical energy.

Individuals in bigger properties will are inclined to pay extra total as a result of greater power utilization, whereas these in smaller properties probably use much less so pay much less.

In addition to saying the brand new worth cap, Ofgem additionally outlined choices to vary the standing cost billing system.

Standing fees are the fastened every day charges paid for being related to the system, however they’re unaffected by how a lot folks use.

The short-term choices offered by the regulator embody a possible plan to maneuver between £20 and £100 from the standing cost to the value paid for each unit of power used, giving prospects the chance to economize by decreasing their utilization.

However many susceptible folks would not have the chance to take action, as they may must preserve the heating on, or use electrical energy to run medical tools.

Mr Brearley stated there was “no silver bullet” when it got here to altering standing fees.

Greg Jackson, the boss of provider Octopus Vitality stated it was “loopy” that standing fees have been so excessive and diversified by area.

How some pensioners can declare help

An estimated 880,000 low-income pensioner households eligible for pension credit score at present fail to say it.

The federal government says it’s price a mean of £3,900 a 12 months and claiming it may well qualify folks for different monetary help comparable to winter gasoline funds.

You’ll be able to examine your eligibility for pension credit score through the federal government’s on-line calculator.

Data can be obtainable on make a declare. There may be additionally a cellphone line obtainable on weekdays – 0800 99 1234.

Information to advantages, while you qualify and what to do if one thing goes improper, are offered by the impartial MoneyHelper web site, backed by authorities.

Advantages calculators are additionally run by Coverage in Apply, and charities Entitledto, and Turn2us.