13 minutes in the past

By Faisal Islam and Lora Jones, Economics editor & Enterprise reporter, BBC Information

Getty Pictures

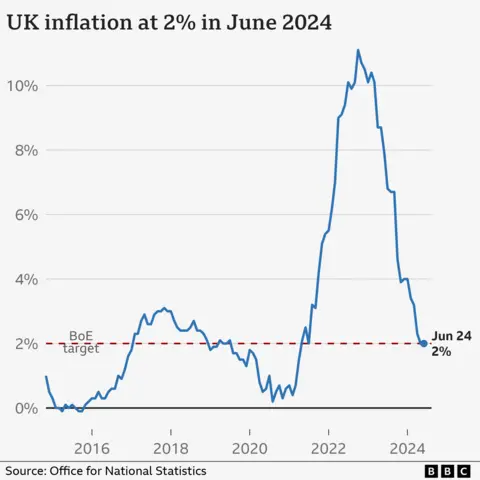

Getty PicturesUK inflation held regular in June regardless of resort costs rising strongly, in response to the most recent official figures.

Whereas costs in eating places and accommodations went up, sharp falls in clothes helped offset this as retailers provided widespread gross sales to customers.

Total, inflation rose at 2% within the yr to June, unchanged from Could.

It implies that the price of dwelling continues to be rising however at a fee that the central financial institution is snug with, after practically three years of above-target inflation which has squeezed family funds.

The most recent information confirmed that costs in eating places and accommodations rose greater than a yr in the past, placing upward stress on the headline inflation fee.

Resort costs soared by 8.8% in contrast with the earlier month, the Workplace for Nationwide Statistics (ONS) mentioned, whereas costs in eating places and cafes went up by 0.3% on a month-to-month foundation.

It additionally confirmed that the prices of bundle holidays, cinemas, theatres and concert events had been rising.

However costs of clothes and footwear fell final month, whereas food and drinks inflation has dropped sharply from the highs of current years.

The figures on Wednesday additionally confirmed that second-hand automobile prices fell however by lower than the identical time final yr.

Nonetheless, in areas like companies, which embody every part from eating places to hairdressers, value will increase stay persistent.

That might elevate questions for Financial institution of England policymakers over when they need to start to chop rates of interest.

Darren Jones, the brand new chief secretary to the Treasury, mentioned that households’ budgets throughout Britain had been nonetheless being squeezed.

“We face the legacy of 14 years of chaos and financial irresponsibility. That’s the reason this authorities is taking the robust choices now to repair the foundations so we are able to rebuild Britain and make each a part of Britain higher off.”

The Financial institution’s base fee – which is used to assist set mortgage charges and different borrowing prices – at the moment stands at a 16-year-high of 5.25% after it was elevated in a bid to sort out hovering inflation.

Its Financial Coverage Committee (MPC), which votes to set the speed, has held rates of interest at this stage for a number of months however some economists have predicted they may reduce the speed on the subsequent vote on 1 August.

Leanne Morgan and her husband Gareth purchased their home in Greenwich, south-east London, in 2016 when rates of interest had been a lot decrease.

Their five-year fastened mortgage deal got here to an finish this month and their new fee stands at simply over 4% – pushing their mortgage funds up by £5,200 a yr.

Mrs Morgan mentioned the upper mortgage funds had restricted the issues they had been in a position to do with their three older youngsters.

“We won’t have household holidays, we have not been in a position to take action a lot with the kids….it impacts the place I store for meals, I’m at all times searching for reductions. We sit collectively, we take a look at what our prices are, the place we are able to in the reduction of and take a look at a funds.”

She mentioned was optimistic, nonetheless, that the UK economic system was over the worst and that higher occasions had been forward.

“I feel typically the doom and gloom that we discuss can really make us really feel very adverse….It you possibly can really feel hopeless,” she mentioned.

“But when we’ve an excellent dialog about what is feasible, and dealing with what we have, we are able to have a greater dialog about it,” she added.

The underlying measures of inflation being watched carefully by the Financial institution of England additionally didn’t change, in response to the most recent information.

Inflation within the companies sector, for instance, remained at 5.7%, whereas core inflation, which strips out the results of extra unstable objects like power costs, held at 3.5%.

Alongside another stronger figures for the economic system in current days, it might give some pause for thought for members of the Financial institution of England committee deciding rates of interest subsequent month.

On Tuesday, the Worldwide Financial Fund listed the UK amongst international locations who would possibly have to preserve rates of interest “greater for even longer” than initially anticipated to squeeze inflation out of the system.

Markets have been anticipating that fee cuts will begin on 1 August, serving to fastened mortgage charges fall.

The most recent numbers recommend will probably be a finely balanced determination.