The British authorities has argued {that a} black gap exists within the public funds to the tune of £22 billion on this monetary 12 months. It claims that coping with this may contain a interval of fiscal restraint, which often means spending cuts.

The main points can be revealed in subsequent month’s finances however we’ve already been informed that the winter gasoline allowance for pensioners can be means examined slightly than out there for everybody. Austerity is as soon as once more on the agenda in British politics.

As Keir Starmer’s Labour meets for its first annual convention in authorities, it should resolve how far it might realistically push this austerity agenda with out compromising on its objective to ship on progress.

Need extra politics protection from educational specialists? Each week, we convey you knowledgeable evaluation of developments in authorities and reality test the claims being made.

Join our weekly politics e-newsletter, delivered each Friday.

When testing how a lot austerity the British public will tolerate, we will look to a latest instance within the insurance policies launched by the Conservative-Liberal Democrat coalition authorities. When the coalition fashioned after the 2010 basic election it launched into main cuts in public spending which did not convey down the deficit.

It additionally vastly broken public providers and native authorities within the course of. This in flip helped to supply the sluggish progress the UK has been experiencing because the nice recession of 2008-2010.

One of many shocking issues about austerity is that there’s little assist for it in financial idea. There’s an apparent drawback for nations like Argentina and Venezuela operating large deficits and attempting to borrow in worldwide markets once they have defaulted on loans up to now.

However a rustic like Britain, which has by no means defaulted and has a comparatively excessive productive capability, can borrow extensively on worldwide markets. That is true so long as it avoids stunning them with sudden unfunded tax reductions of the sort proposed by Liz Truss throughout her temporary interval as prime minister.

A couple of years in the past, American economists Carmen Reinhart and Kenneth Rogoff appeared on the relationship between financial progress and borrowing. Their findings appeared to point out that borrowing which exceeded 60% of GDP would injury progress in developed nations. This argument gave cowl to the coalition authorities’s austerity insurance policies, since in December 2010, a couple of months after the election, borrowing exceeded 70% of GDP. George Osborne, chancellor on the time, cited Reinhart and Rogoff as an proof base to justify his insurance policies.

Embarrassingly for Reinhart and Rogoff, a graduate scholar on the College of Massachusetts, Amherst tried to copy their findings and located that their modelling was filled with coding errors, questionable weighting choices and different methodological faults which threw doubts on their outcomes. This was extensively publicised and largely discredited their findings.

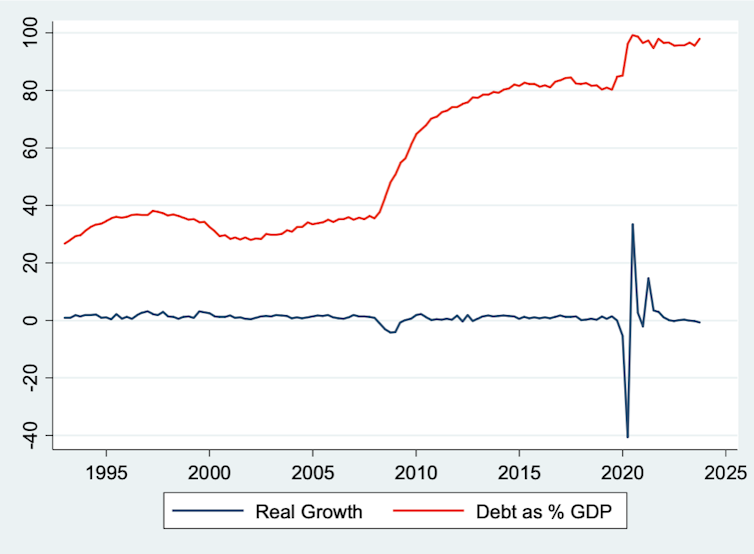

The Relationship between Financial Development and Debt within the UK, 1993-2023:

ONS, CC BY-ND

This implies it’s value wanting once more on the relationship between financial progress and borrowing within the UK over an extended time frame. The chart above reveals that this relationship is negligible (-0.03), indicating that they’re unrelated.

It is very important have in mind different elements which might affect progress when contemplating Labour’s place. One key issue is client confidence, or the extent to which individuals are feeling constructive or unfavourable concerning the state of the financial system and their very own monetary circumstances.

Development and austerity

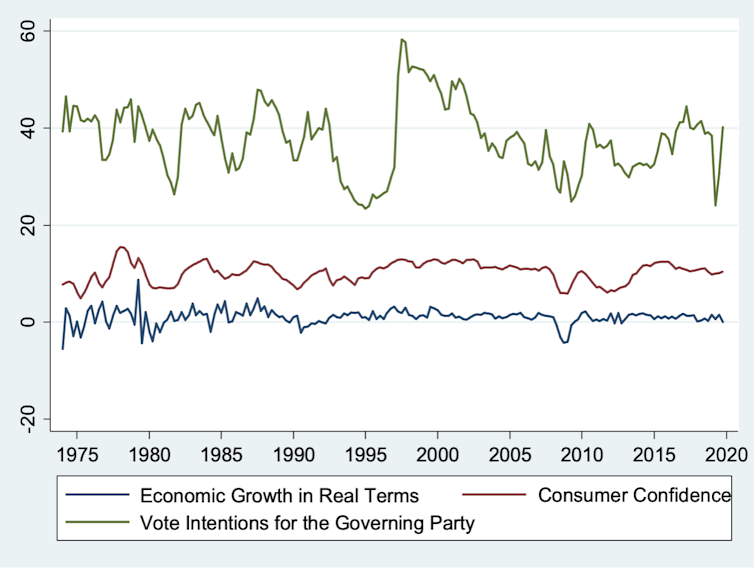

The chart under appears on the relationship between financial progress, client confidence and public assist for successive British governments over a interval of practically half a century, up till 2019, shortly earlier than the pandemic shut down the financial system. It means that one other spherical of austerity could be very prone to scale back progress slightly than stimulate it, and this may have critical penalties for the federal government’s recognition.

Quarterly Authorities Vote Intentions, Shopper Confidence and

Financial Development within the UK 1974 (Q1) to 2019 (This fall):

P Whiteley

Shopper confidence performs an necessary position in figuring out whether or not shoppers will stimulate the financial system by spending cash. The correlation between this measure and financial progress, taking inflation under consideration, is robust (0.46), which signifies that financial optimism and progress go collectively. Not surprisingly, optimism brings progress and pessimism brings stagnation.

There are additionally political penalties of austerity insurance policies, because the correlation between voting intentions for the governing occasion and client confidence can be sturdy (0.47). If the financial system is stagnating, folks really feel pessimistic and they’re prone to blame the federal government for it.

If, then again, they really feel optimistic, then the incumbent occasion will get the credit score and will increase its lead within the polls. We will see this within the dips in confidence in election years that delivered a change of presidency.

Flickr/Treasury, CC BY-NC-ND

Correlations usually are not, in fact, the identical as causation, however additional statistical evaluation reveals that client confidence and progress work together with one another. As confidence will increase financial progress accelerates, and vice versa.

This could produce a virtuous circle of elevated prosperity and authorities recognition. And whereas progress doesn’t immediately have an effect on authorities recognition, it really works through client confidence.

Simply days earlier than Labour’s annual convention, new figures had been launched displaying that client confidence had fallen sharply in September. Individuals had been recorded as being pessimistic concerning the nationwide financial outlook and their very own funds, probably on account of the federal government’s personal messaging concerning the troublesome finances to return.

Starmer and Chancellor Rachael Reeves ought to take a leaf out of the guide of the post-war Labour authorities. An enormous public deficit arising from six years of battle didn’t stop Clement Attlee and his colleagues rebuilding Britain within the post-war years. An austerity finances subsequent month might crash the entire Labour venture of bringing progress again to a stagnant financial system.